north dakota sales tax on vehicles

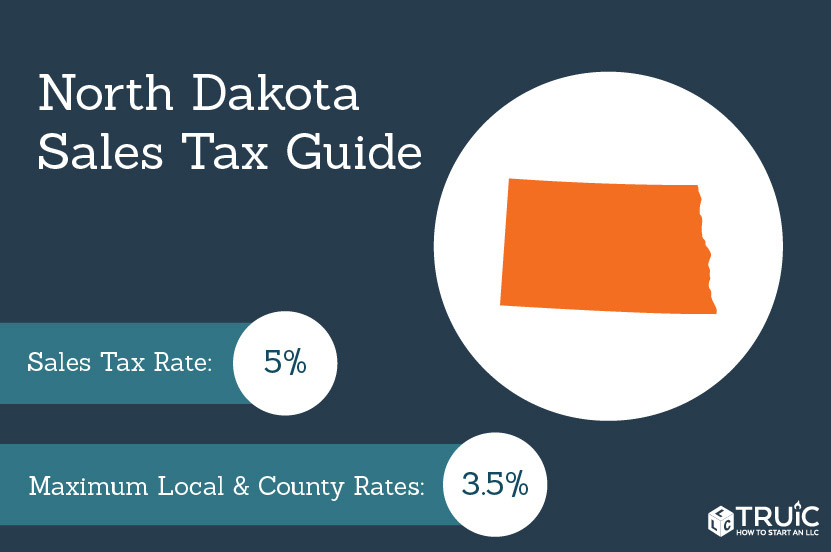

The North Dakota 5 percent sales tax and 3 percent rental surcharge are imposed on rentals of motor vehicle for periods less than 30 daysin this state. North Dakota Title Number.

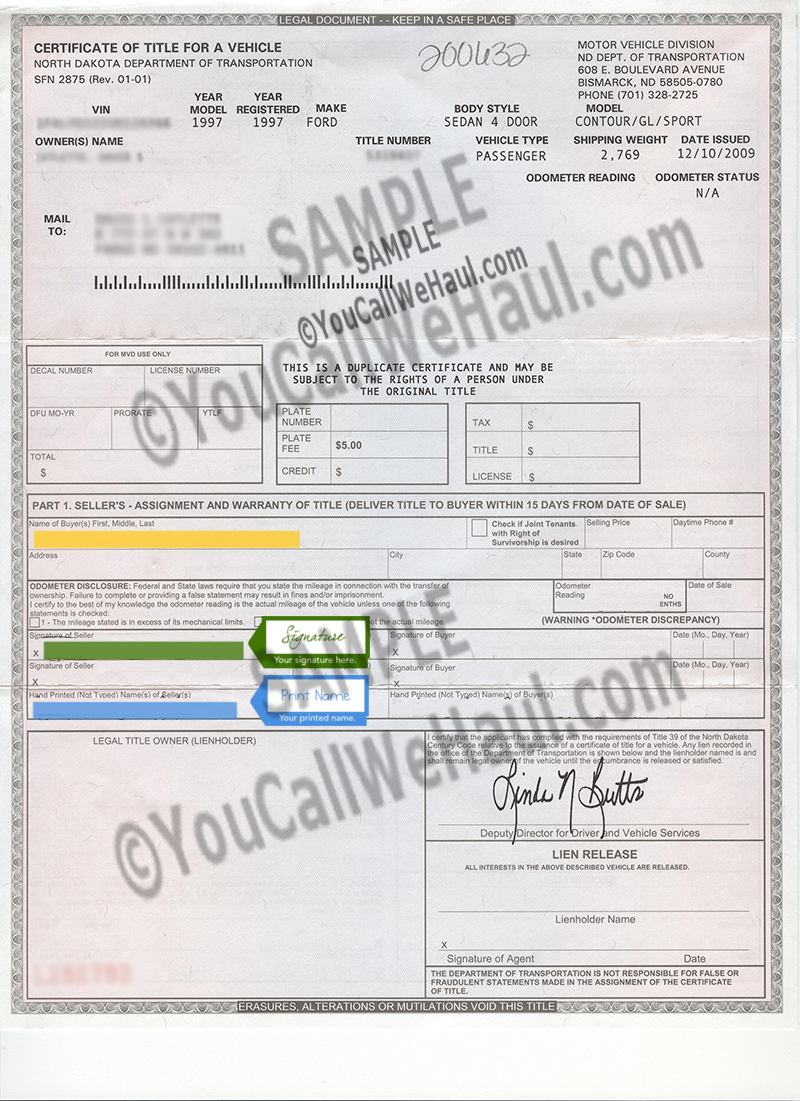

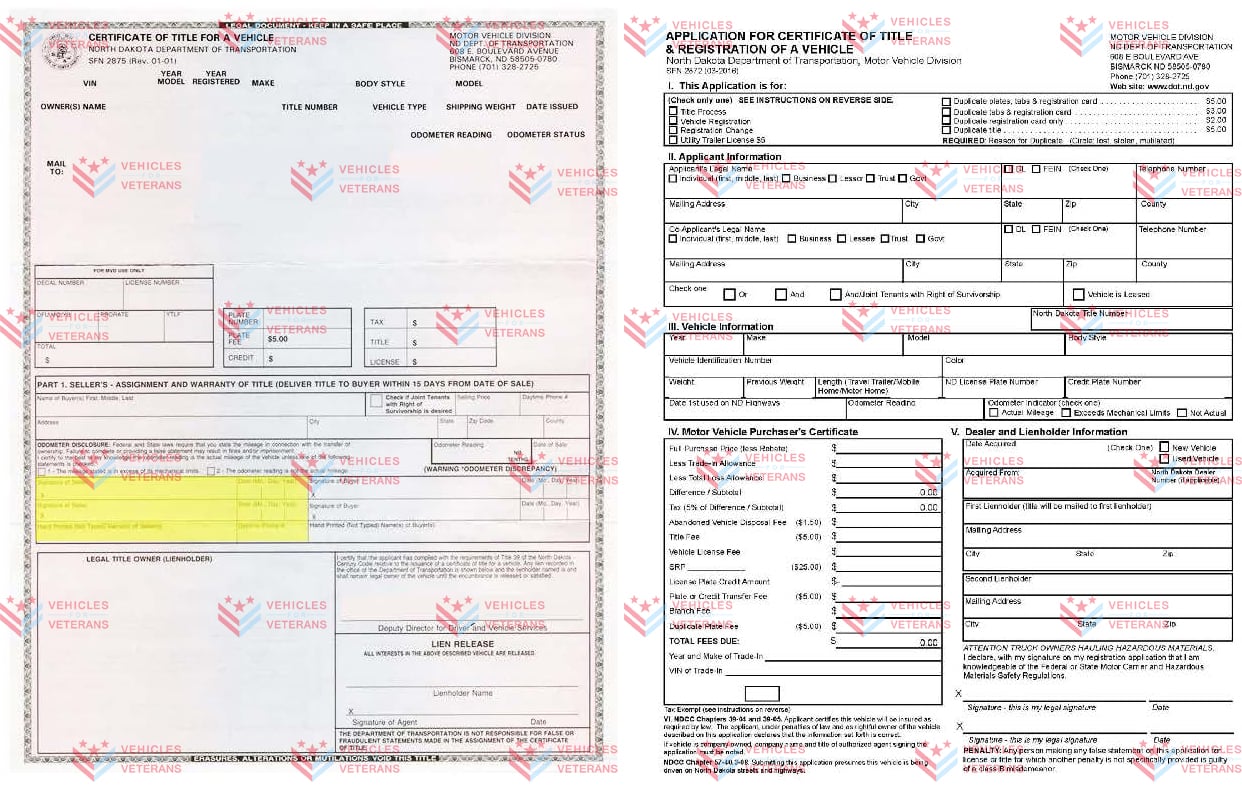

My Vehicle Title What Does A Car Title Look Like

The sales tax is paid by the purchaser and collected by the seller.

. However this does not include any potential local or county taxes. Although North Dakotas regular sales tax can range from. The motor vehicle excise tax is in addition to motor vehicle.

That state we would require proof of tax paid to exempt you from North Dakota excise tax. 31 rows The state sales tax rate in North Dakota is 5000. 1 day agoItems like tampons menstrual pads sanitary napkins and panty liners are now exempt from Louisianas 445 state sales tax.

There is hereby imposed an excise tax at the rate of five percent on the purchase price of any motor vehicle purchased or acquired either in or outside of the state of North Dakota for use. North Dakota sales tax is comprised of 2 parts. The 5 sales tax and the 3 rental surcharge are separate charges with each applying to the rental charges and are in addition to motor vehicle excise tax paid on the.

Motor Vehicle Fuel Tax Gasoline and Gasohol A motor vehicle fuel tax of 023 cents per gallon is imposed on motor. When you buy a car in North Dakota be sure to apply for a new registration within 5 days. While the North Dakota sales tax of 5 applies to most transactions there are certain items that may be exempt from taxation.

Heavy Vehicle Use Tax. The motor vehicle excise tax is in addition to any other tax provided for by law on the purchase price of motor vehicles. North Dakota imposes a sales tax on retail sales.

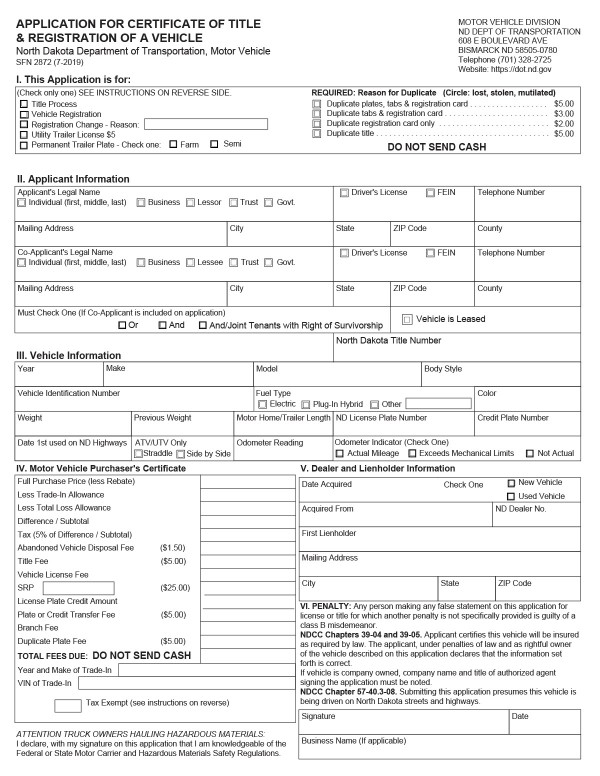

To calculate registration fees online you must have the following information for your vehicle. 2290 IRS Filing Requirements. North Dakota levies a state sales tax rate of 5 percent for most retail sales.

Average Local State Sales Tax. North Dakota has a 5 statewide sales tax rate but also has 213 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0959. If the vehicle was purchased outside of the United States there is no tax reciprocity.

The motor vehicle excise tax must be paid to the North Dakota. The Dealer Handbook contains laws and policies pertaining to vehicle sales. Includes gasoline and gasohol.

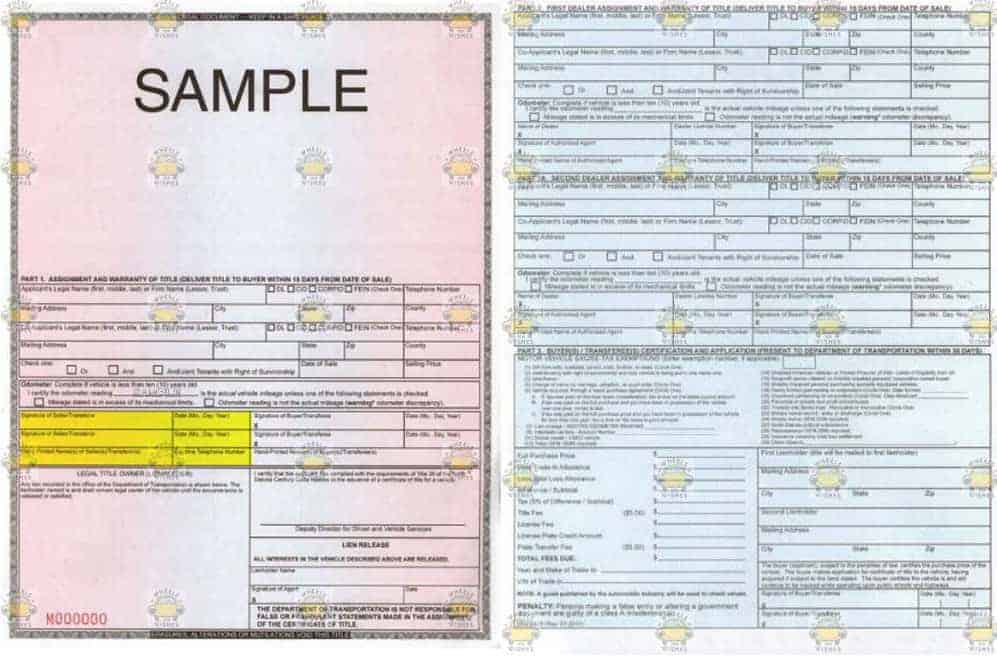

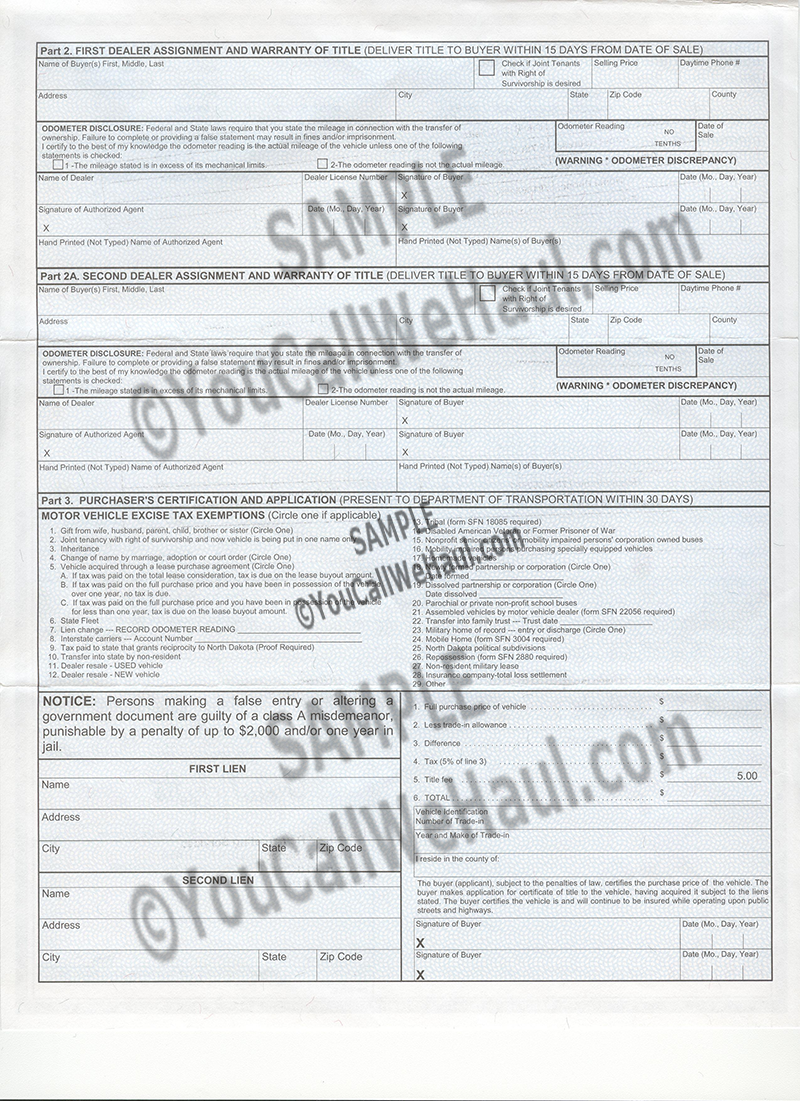

How to complete a North Dakota Motor Vehicle Title. In North Dakota there are 3 types of motor fuel tax. CNN BATON ROUGE La.

North Dakota has a statewide sales tax rate of 5 which has been in place since 1935. North Dakota collects a 5 state sales tax rate on the purchase of all vehicles. Motor vehicle fuel tax.

North Dakota has recent rate changes Thu. Municipal governments in North Dakota are also allowed to collect a local-option sales tax that ranges. You can find these fees further down on the page.

North Dakota Sales Tax. North Dakota has state sales tax of 5 and allows local governments to collect a local option sales tax of up to 3. Average Sales Tax With Local.

The average local tax rate in North Dakota is. Certain items have different sales and use tax rates. Or the following vehicle information.

The statewide sales tax in North Dakota is 5 and that rate applies to any vehicle purchased anywhere in the state. This page discusses various sales tax exemptions in North. In addition to taxes car purchases in North Dakota may be subject to other fees like registration title and plate fees.

You will also need to pay a 5 title transfer fee 5 sales tax and registration fees based on the. North Dakota allows credit for any excise tax paid on a motor vehicle in another state if that state allows a reciprocal credit. The state sales tax on a car purchase in North Dakota is 5.

The 5 percent sales tax and the 3. WAFBGray News Sales. With local taxes the total sales tax rate is between 5000 and 8500.

How To Transfer North Dakota Title And Instructions For Filling Out Your Title

Sales Tax On Cars And Vehicles In South Dakota

What S The Car Sales Tax In Each State Find The Best Car Price

North Dakota Auto Title Services Auto Title Bonded Title Surety Bonds Tax Registration

North Dakota Tax Commissioner Letter Sample 1

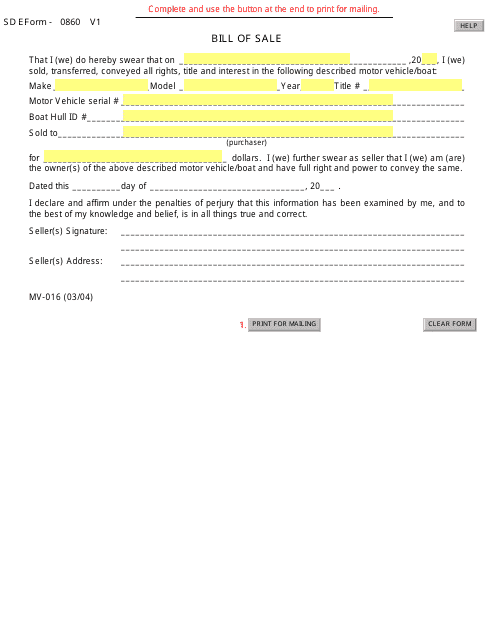

About Bills Of Sale In North Dakota What You Need To Know

South Dakota Vehicle Title Donation Questions

Car Tax By State Usa Manual Car Sales Tax Calculator

North Dakota Sales Tax Small Business Guide Truic

North Dakota Vehicle Title Donation Questions

Pin On Form Sd Vehicle Title Transfer

North Dakota Vehicle Donation Title Questions Vehicles For Veterans

Sales Tax On Cars And Vehicles In Iowa

North Dakota Vehicle Registration Laws Com

Form Mv 016 Sd Form 0860 V1 Download Fillable Pdf Or Fill Online Bill Of Sale For Motor Vehicle Boat South Dakota Templateroller

How To Transfer North Dakota Title And Instructions For Filling Out Your Title